Westwood Global Energy Group, a market analytics for the oil and gas industry, launched a study concerning the exploration drilling in Norway concerning the last five years, and also examined the possible future activity.

Specifically, in the last five years, the annual exploration well count in Norway remains stable at 21-22% since 2016, yet down from 39% in 2014. The oil and gas industry has spent $7.3 billion drilling 138 wells to find 1.2 billion boe of commercial oil and gas with an average discovery size of 44 mmboe and a pre-tax drilling finding cost of $6.1/boe. Fewer than half of the discoveries made were big enough to be considered commercial.

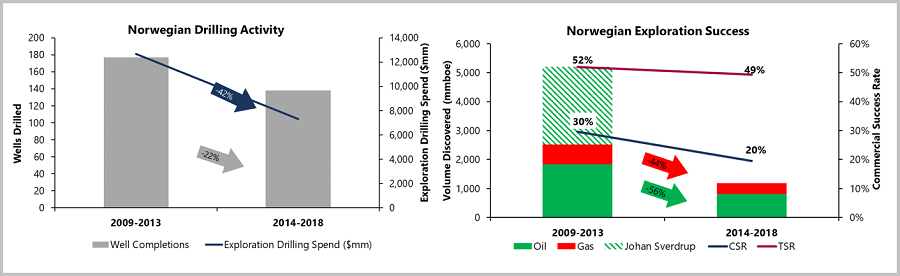

In addition, the last five years, 2014 to 2018, experienced an important deterioration of exploration activity levels and performance in Norway, in comparison to the previous five years. Whilst the number of exploration wells completed was down by around a quarter, discovered commercial volumes reduced by more than half, even when volumes from Johan Sverdrup are discounted in order to show the underlying trends.

Moreover, Westwood noted that the commercial success rates (CSR) saw a reduction from 30% to 20%; Additionally, the technical success rates (TSR) fell from 52% to 49%.

In that case, Westwood commented

(the above) appears to reflect a degradation in quality of the pool of prospects being drilled as the proven plays continue to mature.

Moving on, the study revealed that Barents Sea keeps being disappointing, while the TSR is high, the CSR is the lowest of the Norwegian basins due to the high minimum economic field size required. Interest remains high, however, due to the potential size of the prizes on offer. As a result, activity in the basin still has significant influence on overall company exploration performance.

Also, from the 27 discoveries that were achieved on the NCS in the last five years, only three were more than 100 mmboe, reflecting the decreasing discovery size as the basins mature. Although the Northern North Sea Middle Jurassic was prolific, amid the discovery of commercial hydrocarbons and CSR, the small average discovery size reflects its maturity.

M&A Activity has been on the rise, consolidating the number of active players on the NCS. 16 out of the 33 most active companies on the NCS in the last five years are no longer active, mostly due to merges, acquisitions or divestments

Dramatic increase in high impact drilling

Into 2019, 15 high impact wells are planned, representing a dramatic increase in high impact drilling, up 67% from 2018.

According to the study, the results so far in 2019 have been disappointing with gross CSRs and TSRs falling to 11% and 28% respectively. Several significant wells are yet to spud however, and 2H 2019 results will be a key barometer of Norway’s ability to sustain current exploration activity levels into the future.