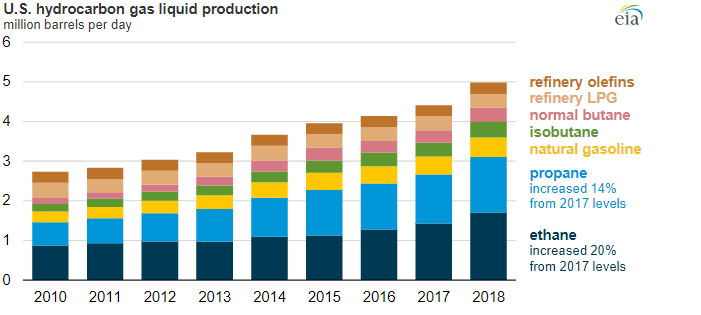

As EIA informs, US production of hydrocarbon gas liquids (HGLs) reached 5 million barrels per day (b/d) in 2018, which is an increase of over 0.5 million b/d (13%) compared to 2017 levels. HGLs accounted for more than a quarter of total US petroleum products output in 2018.

The increase in HGL production since 2010 is mainly due to an increased domestic natural gas production. In 2018, US natural gas production, measured as gross withdrawals, averaged 101.3 billion cubic feet per day (Bcf/d). This is a 38% growth over 2010 levels and the highest volume on record.

As natural gas production has risen, an increasing share of HGLs are produced at natural gas processing plants, from about 75% in 2010 to almost 90% in 2018.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Ethane and propane account for two-thirds of HGL production. Ethane production reached 1.71 million b/d in 2018, a 20% increase over 2017 levels. Ethane can be left in the processed natural gas stream at natural gas processing facilities or it can be recovered from natural gas if ethane’s value is enough to cover the additional costs to produce and distribute the ethane to markets.

Demand for ethane in 2018 was driven by increased use in the petrochemical sector, which converts ethane into ethylene for use in the production of plastics, resins, and fibers that go into the production of many consumer goods. Several new petrochemical crackers were commissioned in the United States in 2018. Chevron Phillips Chemicals and ExxonMobil each commissioned facilities that process an estimated 90,000 b/d of ethane as feedstock. Indorama Ventures commissioned a smaller petrochemical cracker estimated to consume 20,000 b/d of ethane as feedstock.

International demand for ethane also increased, and new export infrastructure—the 50,000 b/d Utopia pipeline to Canada—has increased the capacity to ship ethane abroad.

Except for the petrochemical sector, where demand growth has been robust, the capacity of the US domestic market to consume HGLs has not expanded at the pace of growing supply. The international market has now become the preferred destination for most of the incremental growth in US, EIA informs. HGL exports have also been growing rapidly, especially for propane, increasing 14% over 2017 levels. In 2018, about a third of US HGL production was exported.

In addition, propane production grew from 1.54 million b/d in 2017 to 1.70 million b/d in 2018, marking a 10% increase. Propane demand has also been fairly flat on an annual basis in recent years.

Finally, US production of butanes, natural gasoline, and refinery olefins increased as well in 2018. Domestic markets for normal butane, isobutane, and natural gasoline have experienced relatively slow growth, meaning much of the production increase has been exported.