The UN Conference on Trade and Development issued its Review of Maritime Transport for 2017, presenting key developments in the world economy and international trade and related impacts on shipping demand and supply, and freight and charter markets in 2016 and early 2017, as well as seaports and the regulatory and legal framework.

Highlights

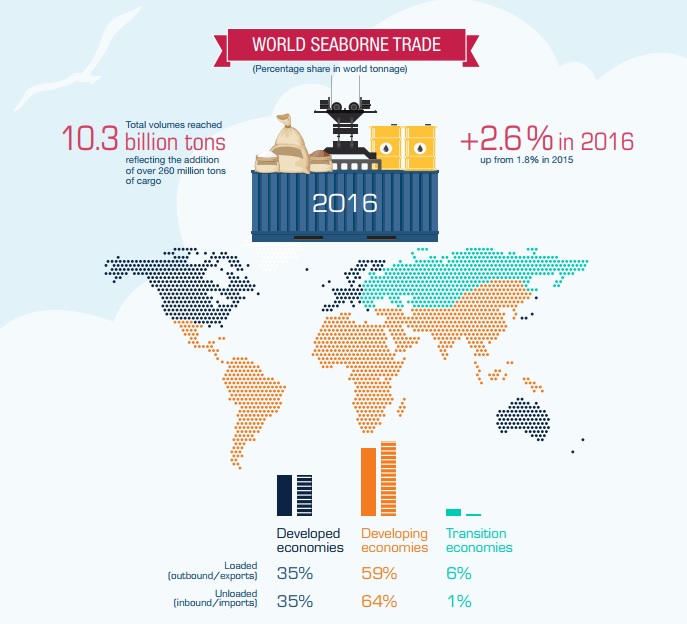

- In 2016, demand for shipping services improved, albeit only moderately. World seaborne trade volumes expanded by 2.6%, up from 1.8% in 2015, but below the historical average of 3% recorded over the past four decades.

- Total volumes reached 10.3 billion tons, reflecting the addition of over 260 million tons of cargo, about half of which was attributed to tanker trade.

- In 2016, world fleet capacity increased by an estimated 3.2%, down from 3.5% in 2015. Dead-weight capacity of the world commercial fleet was 1.86 billion dead-weight tons (dwt) in early 2017, worth $829 billion.

- The squeeze was felt in particular by the container shipping market, which last year reported a collective operating loss of $3.5 billion.

- UNCTAD forecasts world seaborne trade to increase by 2.8% in 2017, with total volumes reaching 10.6 billion tons. Projections for the medium term also point to continued expansion, with volumes growing at an estimated compound annual growth rate of 3.2% between 2017 and 2022.

- Cargo flows are set to expand across all segments, with containerized and major dry bulk commodities trades recording the fastest growth.

The report stresses that there are risks associated with the recent mergers and mega alliances among container carriers.

“The risk is that growing market concentration in container shipping may lead to oligopolistic structures,” says Shamika N. Sirimanne, Director of the UNCTAD Division on Technology and Logistics. “In many developing countries’ markets, there are now only three or even fewer suppliers left. Regulators will need to monitor developments in container shipping mergers and alliances to ensure there is competition in the market,” Ms. Sirimanne says.

Revisiting the rules governing consortiums and alliances may be necessary to determine whether these require new regulations to prevent market power abuse and to balance the interests of shippers, ports and carriers.

Transport costs overburden developing countries : On average, transport and insurance costs account for about 15% of the value of imports, but that this is much higher for smaller and more vulnerable economies; on average 22% for small island developing States, 21% for the least developed countries and 19% for landlocked developing countries. The persistent transport cost burden on many developing countries stems from lower efficiency in ports, inadequate infrastructure, limited economies of scale and less competitive transport markets. Helping developing countries improve the factors behind high transport costs is therefore key for economic development. New technologies create opportunities and risks : New technologies improve economic efficiency, optimize logistics management systems and operations and increase connectivity. Yet these technologies are also raising new concerns, such as increased cybersecurity threats and weakened protection for privacy and financial data. Cybersecurity concerns should be reflected in the regulatory frameworks governing the maritime sector, and regulatory compliance should be encouraged and supported. The enforcement of existing cybersecurity regulations is important, as is the development of additional standards and policies. Liquefied natural gas is on the rise : The use of LNG for fuel is on the rise, amid tightening environmental regulations, as it complies with new emissions control regulations. The share of gross tonnage from liquefied natural gas-capable ships on the order books for delivery in 2018 and beyond stands at 13.5%, more than twice the value in 2017 and more than three times the value in 2015.

Explore more by reading the full report: