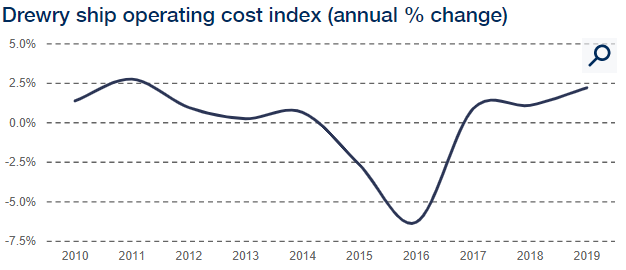

Based on Drewry’s latest Ship Operating Costs Annual Review and Forecast 2019/20 report, it is highlighted that the underlying vessel operating cost inflation moderately increased in 2019 on higher repair and maintenance and insurance spend, with the future costs expected to go on the same pace in 2020.

Accordingly, costs rose for a third year in a row, following the reduction the market showed in the capacity ravaged years of 2015-16.

Opex costs are connected to the wider shipping market growth, whereas additional markets as insurance are lined to asset values and others impacted by the ability of shipowners to pay.

According to Drewry’s estimations, the average daily operating costs on 46 different types of vessels and sizes increased by 2.2% in 2019, in comparison to underlying increases of 1.1% and 0.7% respectively in the previous two years.

Manning costs increased for a second year in a row, by 1.3% in 2019, despite the officer shortage; In the meantime, insurance costs rose by 3.4% having flatlined the previous year.

Costs on stores, spares and lubricants increased for a third year though with the exception of lubes cost inflation remains very moderate.

Expenses on repair and maintenance and dry docking fastened to 3.1% in 2019 on tighter repair yard capacity as a result of a spike in retrofit activity, while costs relating to management and administration increased just 1%.

Drewry’s director of research products Martin Dixon commented that

There are limits to cost cutting, beyond which the safety of the vessel and crew are put at risk, and as freight markets have recovered so pressure to reduce spend has lifted leading to modest acceleration in cost inflation.

The report’s latest assessments, including vessels in the container, chemical, dry bulk, oil tanker, LNG, LPG, general cargo, reefer, roro and car carriers sectors, presents an increase in costs on broad-based across all the main cargo carrying sectors for the second consecutive year, as continued recovery across most cargo shipping markets and rising regulatory compliance requirements lifted cost inflation.

Despite the slight increase stated above, Drewry expects a challenging future for shipowners, due to the uncertain trade outlook and benign capacity conditions prove temporary when the current round of retrofits recedes.

Mr Dixon concluded that

Other cost heads, beyond the direct control of shipowners, will prove tougher to manage, particularly insurance where we expect costs to rise sharply in 2020. Continued attempts to clean up and decarbonise shipping will add to owner cost burdens, affecting management & administration, repair and maintenance and dry docking costs in particular, as retrofitted equipment adds to maintenance costs.