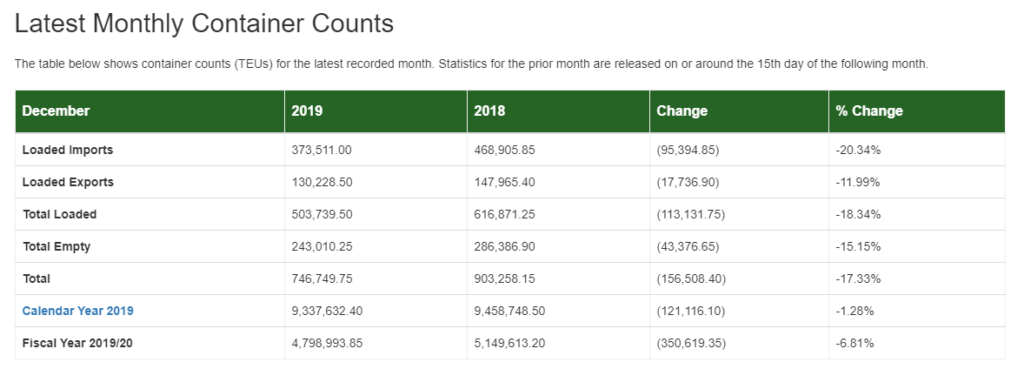

The Port Executive Director Gene Seroka recently announced that the Port of Los Angeles moved near-record cargo in 2019 with a total of 9,337,632 Twenty-Foot Equivalent Units (TEUs), just short of the second-best year in its 113-year history, despite lingering tensions from the U.S.-China trade war.

It is said that the near-record volumes come despite a more than year-over-year 17% decline in total TEUs in December 2019, a 12% drop off in November, and 18% drop off in October.

In fact, Seroka said that

In the face of lagging exports due to international trade tensions and tariff uncertainties, the Port of Los Angeles has maintained strong momentum and kept cargo flowing.

Namely, overall, 2019 exports were up a 3.7% to 4,473,788 TEUs year-over-year, but still down 0.4% from 2017’s peak of 4,491,644 exported TEUs.

The Port Executive Director added that

This feat was only possible because of the extensive cooperation and continued efficiency improvements by our terminal operators, supply chain partners and longshore workforce.

In his speech at the annual State of the Port event hosted by the Pacific Merchant Shipping Association last week, Seroka outlined several initiatives that will come into existence in 2020, such as initiatives for terminal efficiency, digital leadership and workforce development.

Seroka highlighted that it is now the time to encourage the vision to imagine what the port will look like in the years ahead and take all relevant measures. The Executive Director stressed that

It’s going to take collaboration to keep cargo volumes strong and our Port community thriving in the midst of increasing competition, an uncertain trade environment and a world where technology is essential to success.”

Seroka reiterated 2020 as an important year for ongoing implementation of the port’s Clean Air Action Plan, as well as the its continued pursuit of zero-emission technology to further build on emission reductions achieved over the last decade.

Currently, the Port is testing 78 zero-emission drayage trucks and 74 zero-emission yard tractors; while working with Port partners to test eight new zero-emission top handlers in the coming year.

In 2020, there will be additional demonstration projects, including a new large-scale zero-emission drayage truck project testing a fleet of 50-100 zero-emission trucks.

Recently, the Global Port Tracker report by the National Retail Federation and Hackett Associates suggests that after a year of fluctuations driven by the uncertainty of the trade war with China, volume at the nation’s major retail container ports is expected to return to its usual seasonal patterns during the first few months of 2020.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

In fact, according the Global Port Tracker, U.S. ports handled 1.67 million Twenty-Foot Equivalent Units in November, the latest month for which after-the-fact numbers are available; that was down 11.2% from October and 7.5% lower year-over-year.

With on-again, off-again progress on trade negotiations reported throughout the fall as well as other factors affecting shipping, an expected surge ahead of the canceled December tariff increase did not materialize.

Specifically, December was estimated at 1.7 million TEU, 13.4% down from unusually high numbers seen in December 2018, when retailers had frontloaded imports ahead of a scheduled January 1, 2019 tariff increase that was ultimately postponed.