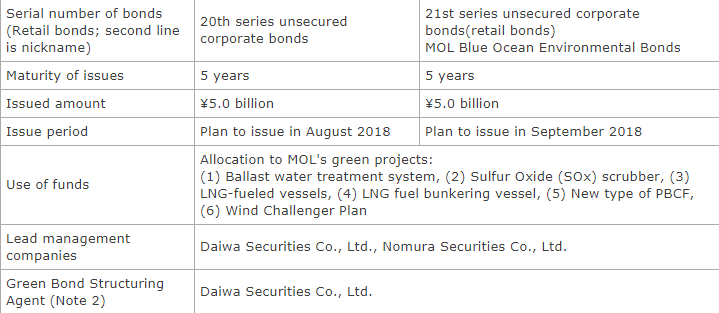

MOL issued Japan’s green bonds through a public offering in the country’s domestic market. It also announced the acquisition of a second opinion from a third-party institute.

Green bonds are used to raise funds for businesses aimed at protecting and improving the environment. MOL established the MOL Group Environmental Vision 2030 in April 2017, and designated environment-related and emission-free businesses as core activities in its “Rolling Plan 2018″ management plan.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

The bonds are targeted to both institutional and individual investors. This is the first time a company in Japan has issued green bonds aimed at individual investors.

According to MOL, the funds will be used for the following uses:

- Ballast water treatment system;

- SOx scrubber;

- LNG-fueled vessel;

- LNG bunkering vessel;

- New Propeller Boss Cap Fins (PBCF);

- Wind Challenger Plan.

Earlier this year, NYK issued green bonds in a public offering, becoming the first company that publishes green bonds in the international shipping industry.

In addition, as part of its environmental sustainability targets and in line with Taiwan’s green finance policy, Taiwanese shipping giant Evergreen has issued its first green bonds, becoming the second shipping firm globally to do so, after the Japanese NYK.