Lloyd’s Register (LR) has published its FOBAS Fuel Insight report for the second half of 2024 highlighting a continued trend upwards in the use of biofuel.

The latest LR Fuel quality report examines the second half of 2024 as well as wider issues in the marine fuel market and gives a brief look ahead to 2025 where there are likely to be further changes and shifts in the type of fuels being bunkered with further uptake of biofuels to meet Greenhouse Gas (GHG) reduction targets from EU and IMO and the imminent introduction of the Mediterranean Sulphur Emission Control Area from 1 May 2025.

2024 at a glance

Broadly speaking the second half of 2024 has continued in the same direction as the first half in terms of fuel quality with the usual type of issues being faced. There is a continued trend upwards in use of biofuel.

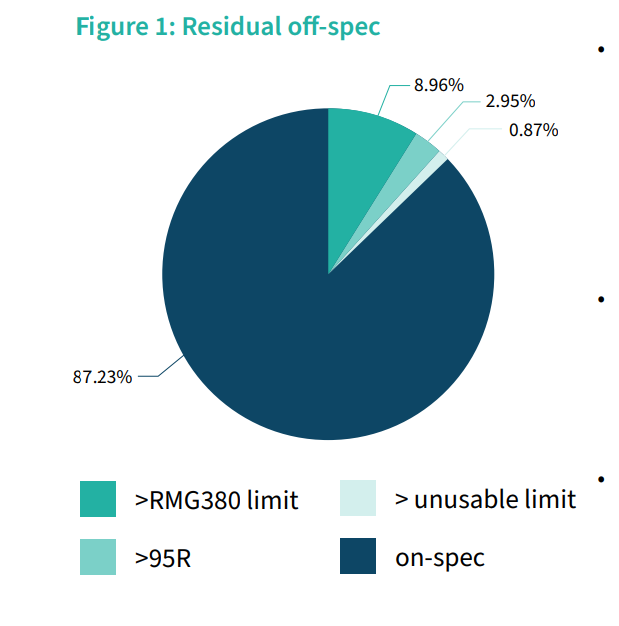

The majority of residual fuels bunkered in 2024 were on-spec, particularly when allowing for the 95% confidence range of the specific limit. One of the biggest issues remains off-spec sulphur results. Close to 2.5% of Residual based VLSFO fuels, based on the recipient’s sample, had a tested sulphur of between 0.50%m/m and 0.53%m/m; these fuels can be considered still usable and, in compliance with Marpol Annex VI and the 0.50% limit, any onboard samples taken during an inspection have this same tolerance range up to 0.53%m/m applied.

However, results in this range still cause some confusion and concern with ship operators, and suppliers should therefore still be aiming to meet the 0.50% limit exactly with the margin of error on the lower side of the limit (i.e. 0.47%m/m or below). These numbers have continued to improve in 2024 after reducing already in 2023 but are still an issue.

Bio-fuel – FAME

In 2024 there has been an increase in the number of ship operators starting to use biofuels onboard on regular basis or at least trialing to gain necessary experience. There are a number of different products that could be described as biofuel, so there’s a need to be careful to be sure of exactly what is being referred to. This is particularly important for any ship operator purchasing fuel where they must be clear what they are actually agreeing to load when offered a biofuel.

Selection of established “biofuels” against standardised specifications

- FAME – Fatty Acid Methyl Ester (most common product when referring to biodiesel) – quality standards EN 14214 and ASTM D6751

- HVO – Hydrotreated vegetable oils (paraffinic diesel known as renewable or green diesel) quality standard EN 15940

In addition, there is a continued increase in the use of biofuels and in particular VLSFO/FAME blends falling under the new 8217:2024 RF grades (although still more often referred to as B30 or similar). This range of VLSFO to FAME seems to be common for a number of reasons. Firstly, it leaves the product still with properties generally in line with a standard VLSFO.

The % of FAME is also limited in some ports by regulations relating to what the supply barges can and cannot carry depending on their class i.e. whether an IBC Annex 1 tanker, which bunker barges are very often, or an IBC Annex II rated chemical product tanker.

According to LR, B30 FAME based fuels have been used now by a number of vessels without any reported problems. It is important to realise that with 70% VLSFO the majority of issues reported relate to this part of the blend rather than the 30% FAME, whether relating to high Sulphur, cat-fines, Sediments etc., all of which are not an issue with FAME. Where there may be problems is when the FAME itself does not meet the required quality standard, such as EN14214.

So far this does not seem to have been a big issue, but looking ahead as the supply of FAME may struggle to match increased demand, there may be a risk of lowering of quality, which will need to be monitored. Some vessels have been also seen using FAME-based blends that are marketed as a brand name and the supplier gives their own quality spec limits. However, lacking in the necessary transparency of what product exactly has been blended, which is also needed for the clarity in the GHG calculations. It can be a concern where no exact definition is given for the products used in the blend.

However, LR reports that the experience with some of the more popular blends seems so far to be generally positive. Singapore is where the most VLSFO/FAME based bio-fuel bunkering is seen. However, recently, more fuels from Algeciras also seem to be popular along with ports in the ARA region.

Year ahead

- Mediterranean Sulphur Emission Control Area

On the 1st of May 2024, MARPOL Annex VI has been updated with the addition of regulation 14.3.5 referring to Mediterranean Emission Control Areas, officially came into force on the aforementioned date. This confirms that ships operating in Mediterranean Sea need to comply with regulation 14.4 of MARPOL Annex VI i.e., the sulphur content of the fuel used onboard ships operating in an emission control area shall not exceed 0.10% m/m (unless the ship is using a sulphur-oxides abatement technology such as exhaust gas scrubbers).

Currently, ships are exempt from this requirement until 1st May 2025 as per regulation 14.7 of MARPOL Annex VI which states that during the first 12 months of any amendment to the specified emission control area, ships operating in that area are exempt from the requirements of paragraph 4, 5 and 6 of regulation 14. This may mean a significant change for many ships and could also affect the types of fuel available at certain ports, so it will be essential to carefully plan for this change in advance of 1st May 2025.

- EU ETS, FuelEU Maritime, and Carbon Intensity Indicator

Along with the new ISO8217 standard there is also the inclusion of the marine industry in the EU ETS (emissions trading system) and, along with other IMO, EU and wider industry pressures, there will likely be more incentive to start switching to biofuels for many vessels and with this a continually growing bio-fuel supply market. This will bring challenges in terms of availability and cost, as well as clearly understanding the relevant regulatory requirements, and will also introduce challenges from a fuel quality point of view.

LR points out that there have been some problems where untested bio oils are being sold without proper understanding of the performance implications on a marine engine and fuel system. This malpractice is likely to continue as the industry looks to meet demand and reduce costs.

- Alternative fuels

There of course is also continuing development and progress on zero or near-zero carbon fuels’, such as methanol, hydrogen, and ammonia. These new fuels introduce a number of issues to consider but will be important parts of the overall fuel mix going forwards and for the foreseeable future alongside traditional marine residual and distillate fuels and drop-in fuels.