The World LPG Association (WLPGA) issued a Guide for LPG Marine Fuel Supply, which is dedicated to the use of LPG in the marine sector and its benefits. The report, presents an overview of key LPG bunkering developments and how this potential infrastructure relates to major global shipping routes.

The report mainly analyzes:

- An overview of key LPG bunkering developments and how this potential infrastructure relates to major global shipping routes, traditional oil bunkering ports, and the bulk LPG infrastructure which will provide the foundation for future LPG bunkering service;

- An incorporation of various case studies describing the bunkering projects being developed at specific locations;

- Barriers to growth and recommendations.

With environmental regulatory pressure increasing to reduce emissions from ship transportation, along with the need for stricter sulphur content limits to marine bunker fuel, are driving LPG bunkering, as well as LPG fueling infrastructure.

Namely, the report notes that one viable option for complying with these demands for reduced emission is to use LPG as a marine fuel.

The conversion of ship fuel from HFO to LPG with cleaner emissions is expected to proceed to LPG fueled ships. Considering that it is required to build a global network of LPG bunkering bases in order to further promote LPG fueled ships

LPG as a bunker fuel

Five are the main factors that make LPG appear an attractive alternative:

- Compliance with emissions regulations: LPG enables vessels to meet MARPOL Annex VI requirements for both worldwide trades and operation in ECAs as its sulphur content that is well below the requirements for ECAs. LPG also reduces NOx emissions to levels that will meet MARPOL Annex VI without need for after treatment;

- Economic and cost drivers: LPG has lower price than HSFO on a heating value basis. The main drawback of LPG are the uncertainties in future LPG price levels;

- Share of operation time of the vessel spent inside ECAs;

- Price difference between LPG and HFO, LSFO, MGO;

- Investment costs for LPG tank and fuel system.

In fact, the global LPG production in 2017, was 308mn tonnes, rising from 305mn tonnes in 2016, marking a year-on-year increase of 1.4%. What is more, LPG supply is soaring ahead of growing global natural gas production, something that is expected to come mostly from the US, while Asia will lead the increase in demand.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Currently, WLPGA estimates that the market for LPG as a bunker fuel will grow at an important rate over the next few years. Demand for LPG will increase, mainly in the residential and commercial sectors of developing and more developed countries. Specifically, the use of cleaner liquid and gaseous fuels is expected to continue its rising, as populations grow and total demand for energy in these regions grows as well. In the meantime, oil and gas prices have increased to improving the economics of LPG, thus leading in stronger transportation demands for LPG. .

Additionally, as several marine infrastructure LPG projects are already in the planning stage, many more are expected.

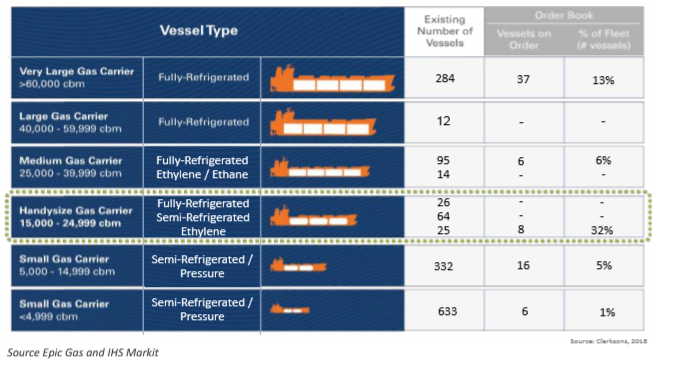

As access to LPG increases and markets open up, offshore terminals will increasingly play an important role in the overall safety and efficiency of these projects. LPG is today a technically feasible option as an alternative fuel for shipping and present an interesting uptake, especially in some ship types

the report explains.

Furthermore, the industry is well prepared for LPG as fuel. According to studies performed in ports, where technical, operational and commercial constraints exist, LPG bunkering is better served by LPG bunkering ships than truck loading or via jetties.

As a matter of fact, LPG bunkering can occur in many different ways, such as from terminals or trucks on-shore or from bunkering vessels.

Moreover, bunkering of larger ships in a harbor, normally takes place through a ship to ship transfer. This is likely to be also the case for LPG bunkering, while for smaller ships bunkering, road or rail tankers, it could be the most economic and convenient option.

However, there are certain regulations to consider, when individual local authorities and the responsible port authorities need to permit LPG bunkering at the chosen location.

Additionally, while LPG offers significant economic and environmental opportunities, its successful implementation has still some possible obstacles to overcome. Many different actors have a considerable interest in the topic, which complicates decisions. These stakeholders are very important in the development process and their involvement is vital.

Nevertheless, WLPGA highlights that LPG can effectively be supplied as a bunker fuel to vessels using current facilities, like terminals and refineries. This will save on initial costs to develop infrastructure, as there are likely to be over 1,000 such facilities that provide LPG storage around the world.

Conclusions

To summarize, the report concludes in three key findings, which are the following:

- Sufficient potential infrastructure for distribution of LPG is available to serve potential marine market demand;

- Engine technology for using LPG as fuel has been developed for a wide range of power outputs.

- The economic incentive in the fuel price difference alone is going to attract more ship owners to invest in LPG fueled fleets in the near future and use as bunker fuel.

Explore more in the following PDF