According to Gibson, nearly 63% of all tankers (above 25k dwt) built in 2009 or older are engaged in grey fleet activity by either trading sanctioned Iranian, sanctioned Venezuelan and/or have been solely engaged in Russian trade over the past 6 months.

As per Gibson estimates, the trading lifespan of these vessels is undoubtedly longer than in the conventional market. However, there is no clear indication of likely scrapping age. Gibson mentions that will be very challenging, if not impossible to accurately assess the prospects for tanker demolition and evaluate it against the existing orderbook.

Even if these vessels are not scrapped, they remain unfixable by a large portion of the tanker market. This is restricting further the tonnage supply to mainstream players, despite rising tanker deliveries in the years ahead.

…Gibson pointed out.

Despite this, ordering activity has been particularly strong in the VLCC segment, with 42 confirmed and 16 reported in the media, the highest number since 2015. Investment has also been relatively high for MRs, with over 130 orders placed since January, compared to circa 145 orders last year. In contrast, there has been a slowdown in orders for Suezmaxes and Aframaxes/LR2s, with 35 and 67 orders placed this year, down notably relative to last year’s investment.

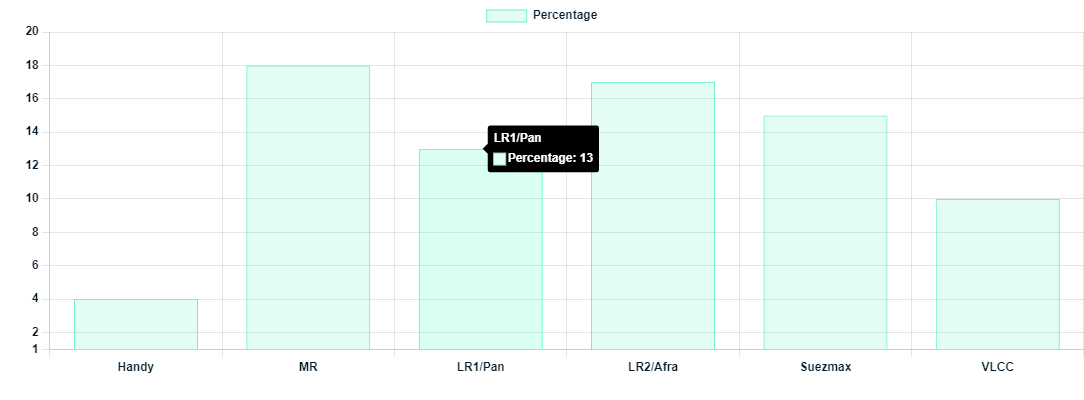

A rare increase in Handy and LR1/Panamax orders has also been witnessed, following years of underinvestment in these segments for most of the last decade. Naturally, the tanker orderbook has swelled. LR2/Aframaxes and MRs have the highest orderbook relative to their existing fleet, at 17.5% and 17.2% respectively. The Suezmax orderbook currently stands at 15%, followed by LR1/Panamaxes, which have nearly 13% of the existing fleet on order. VLCCs still have a relatively restricted orderbook at 9.7% of the existing fleet, whilst Handies continue to have the smallest orderbook of all – at just 3.6%, Gibson notes.

As explained, an impressive increase in new tanker investment is for the most part driven by a major uplift in industry returns and tanker tonne miles since the Russian invasion of Ukraine and sales of predominantly aging tankers into Russian trade. For some, newbuilds may also offer better value relative to secondhand tonnage, despite a delayed delivery. Since late 2020, newbuilding prices have on average appreciated by around 55% compared to 100% to 165% growth in secondhand values, with prices of 15-year-old ships seeing the biggest gains, Gibson informs.