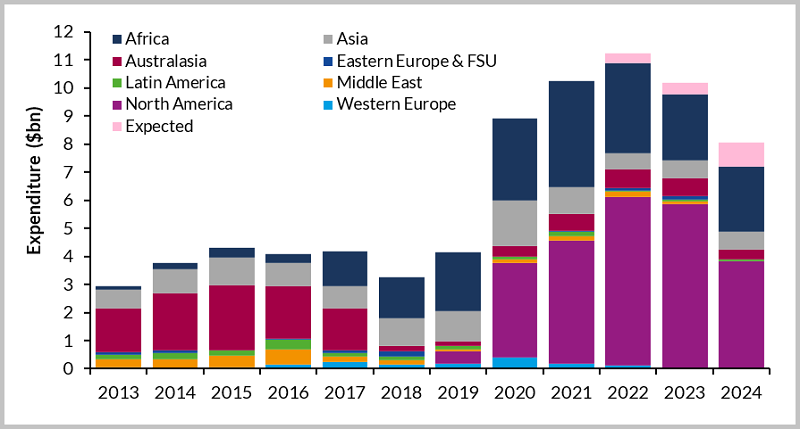

According to Westwood’s World FLNG Market Forecast 2019-2024 for sanctioned and upcoming projects, global FLNG capital expenditure (Capex) is expected to reach $52.8 billion (bn) over the 2019-2024 period.

As LNG exports are based in the US, investment in floating liquefaction facilities in North America will play an important role in global FLNG expenditure for this period, accounting for 45% of expenditure. Technological maturity, improved macroeconomic outlook, and cost reduction in the supply chain, will also support an increase in project sanctioning over the next 24 months.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Following a 22-month pause in project sanctioning, the FLNG industry is experiencing a ‘second wave’ of developments. As more FLNG units are starting operations, there are project structures and financing more similar to the well-established FPSO sector. This includes a move to syndicated project financing and Construction Financing / Sale and Leaseback structures.

Moreover, economic growth and fuel switching increased the gas demand. However, the key driver for the use of floating units still remains the short lead-time from sanction to operation and thus tendering activity for FSRUs will remain strong over the 2019-2024 period.

In summary, the key conclusions of Westwood’s FLNG analysis are the following:

- Over the 2019-2024 period, liquefaction vessels will account for 80% forecast expenditure, totalling $42bn. This investment will lead to the installation 15 FLNG vessels and an addition of 47.9 mmtpa to global export capacity by the end of the forecast period.

- With the challenging market conditions seen over 2015-2017 starting to ease, forecast FLNG expenditure is expected to grow at a 14% CAGR, as operators seek to take advantage of the current competitive pricing structure within the oilfield services and equipment sectors.

- Forecast liquefaction spend in Africa will total $15.4bn over 2019-2024, with 34% of this spend already committed.

- Gas-to-power projects will account for a significant proportion of import vessel demand in Africa and Asia.

- Strong global fundamentals for regasification vessels have prompted some leasing contractors to sign letters of intent (LOI) for optional units to be delivered in the latter years of the forecast.

- A total of 18 countries are expected to have their first floating import vessels installed over the forecast period.

You can see more on the report here