EIA notes that in January 2024, LPG volumes decreased through the Suez Canal by 84% and around the Cape of Good Hope by 44% compared with December 2023.

According to EIA, tankers carrying U.S. LPG, which typically transit the Panama Canal to destinations in East Asia, last year started traveling more frequently through the Suez Canal or around the Cape of Good Hope. Monthly U.S. LPG volumes through the Suez started increasing in August, reaching 374,000 barrels per day (b/d) in November and 179,000 b/d in December, nearly 172% more than the rest of 2023 (January to October).

A journey from the United States to Asia through the Suez Canal requires navigating the Red Sea and then the Bab el-Mandeb Strait. In mid-November, attacks on vessels by Yemen-based Houthi rebels decreased transit volumes through the Bab el-Mandeb in December and increased transit volumes around the Cape of Good Hope.

In late-November and in December, shipments of U.S. LPG rose 135% around the Cape of Good Hope. Ethane tankers, which are almost exclusively VLECs en route to Asia, also shifted to routes around the Cape of Good Hope. One China-bound VLEC from the United States per month starting in August took the longer route, according to vessel tracking data.

In November, 87% less U.S. ethane moved through the Suez Canal compared with monthly averages earlier in the year, a route that makes regular export runs to India.

As mentioned, in January 2024, LPG volumes decreased through the Suez Canal by 84% and around the Cape of Good Hope by 44% compared with December 2023. Shipments through the Suez Canal decreased more than shipments around the more risk-averse Cape of Good Hope.

In contrast, LPG volumes increased in the Panama Canal in January. But in the Suez Canal, January U.S. ethane export volumes stopped because all shipments that regularly transited through the Suez Canal from the United States to India decided to use the longer Cape of Good Hope route.

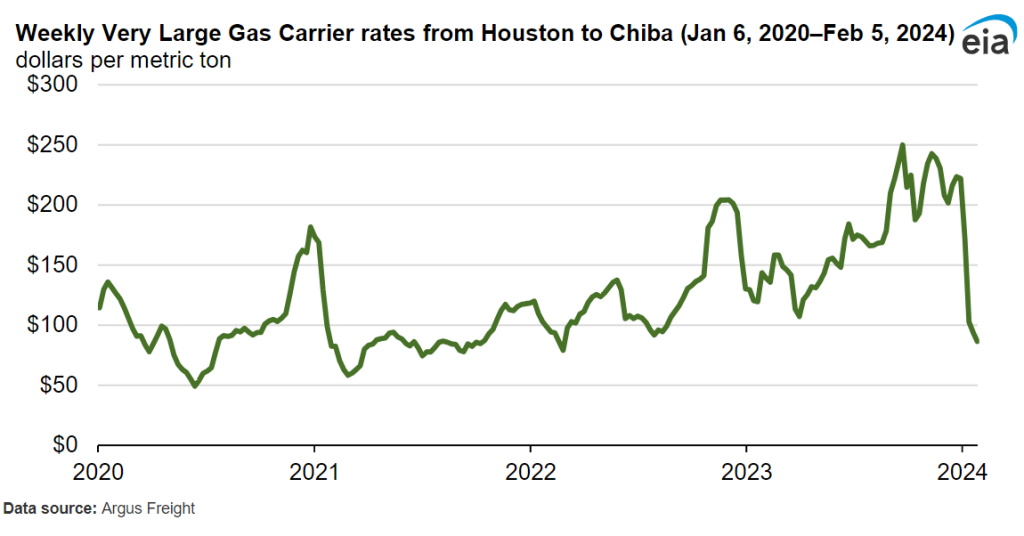

As more booking slots opened in January, the number of vessels transiting the Panama Canal increased, and VLGC rates from Houston to Chiba dropped to $86 per metric ton. Benchmark VLGC rates for the U.S. Gulf Coast to Chiba, Japan, (East Asia) route reached a record high at the end of September 2023.

VLGC rates on this route reached $250 per metric ton for the week ending September 29, the highest since rates were first published in 2016. By the last week of December, rates were $222 per metric ton.

VLGC rates have reached record highs because of the delays at the Panama Canal and the longer distances traveled for the vessels that opted to travel on alternative routes. Further distances incur higher fuel costs.

A typical VLGC spends between $27,000 to $35,000 per day on marine gas oil, but a vessel using LPG dual-fueled engines spends between $20,000 and $24,000 on LPG bunker fuel, based on average 2023 fuel prices.

Even with record delays at the Panama Canal in November and December 2023, according to Argus, water levels also increased. Weekly U.S. propane exports have also been the highest ever, averaging well over 1.7 million b/d from November 2023 to February 2024.

Strong demand for U.S. LPG, especially propane, has increased volumes crossing the Panama Canal toward Asia. With record demand, January 2024 volumes transiting the Panama Canal for both LPG and ethane have increased, and VLGC rates are the lowest since 2022.