According to BIMCO, the dry bulk shipping industry is still on the road to recovery, as demand continues to be more that the fleet growth. In the mean time, scrapping and ordering remain at low levels.

The improved situation during 2017 is seen in the freight rate levels during the first four months of 2018, Peter Sand said. Freight rates for Handysize, Supramax and Panamax increased by 25-27%, in comparison to the same period of last year.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Capesize freight rates improved by only 5% and stayed within loss-making territory at USD 12,660 per day, needing at least USD 15,000 per day on industry average to cover all costs.

However, shipped volumes during the first quarter of 2018 were stronger than expected, except for iron ore. Reported sales from the world’s top 3 iron ore mining companies were decreased by 9% in Q1-2018 compared to Q4-2017. Total seaborne iron ore exports went also down by 11%. This affected capesize freight rates, which took a deep dive during March to hit USD 7,051 per day on 5 April, before bouncing back in the second half of April.

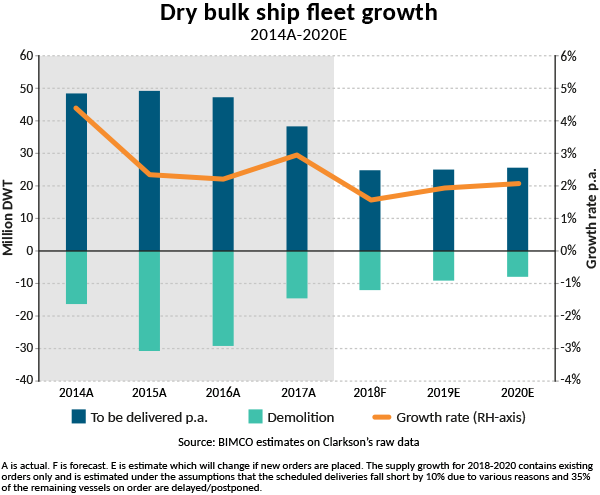

In the beginning of 2018, the dry bulk fleet increased by 10.2 million DWT net, equal to 1.2%. 12.1 million DWT was delivered while 1.7 million DWT was sold for breaker’s yards. 44% of the new capacity was added to the capesize, VLOC and Valemax segments at the top of the chart. 27 out of the 114 delivered newbuilds were Handysizes with a capacity less than 40,000 DWT.

While the low level of newbuilding orders is consistent with being on the road to recovery, the low level of demolition activity is not. Mr. Sand noted that dry bulk demolition during the first four months was reduced by 73% compared to last year.

Nevertheless, a trade war between the US and China could upset the recovery. This situation has already caused a lot of commotion, affecting the dry bulk shipping industry.

Additionally, the second quarter of 2018 is expected to bring more cargoes. Brazil and Australia will both grow its exports of iron ore, while soya bean exports will grow out of Brazil slowing out of the US.

As for China, its steel mills should reduce production capacity, BIMCO notes, adding that it has seen an unchanged production level. However, China builds new mills that are using higher quality imported iron ore.