According to Drewry, China’s evolving grain import strategy reflects its increasing focus on domestic production reshaping the global grain trade, particularly the tonne-mile demand for Panamax vessels.

China remains one of the world’s largest grain producers and also a significant food exporter as of 2024. At the 2023 Central Rural Work Conference, China re-emphasised the importance of grain production and supply.

As per the Chinese Government, the country aims to meet nearly 90% of its grain needs (including wheat and corn) through domestic production by 2032 in response to shifting geopolitical dynamics and ongoing efforts to enhance food security, says Drewry.

China’s grain shift sets sail for lower shipping rates

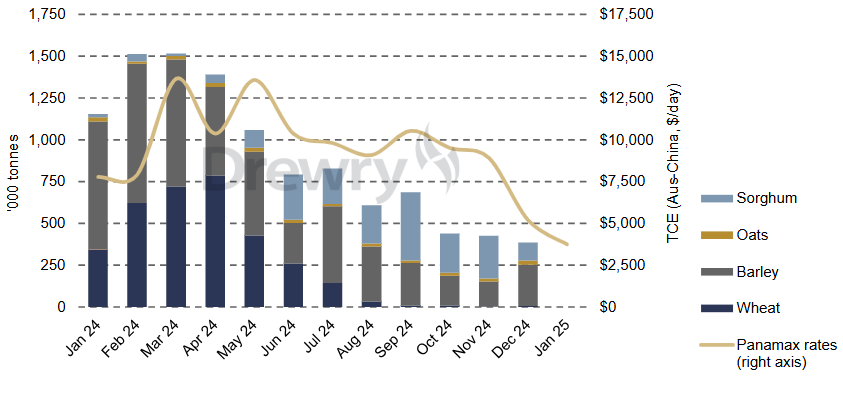

China’s reduced wheat and corn imports are set to affect global shipping demand. The decline in imports and rising domestic production will weigh on the tonne-mile demand for Panamax vessels, which, as per Drewry AIS, handle 75% of China’s grain trade.

Competition among exporters, particularly from Brazil and Australia, will increase further putting downward pressure on shipping rates.

Panamax Baltic rates continued to fall as we entered 2025 Drewry pointed out, and comparing the weekly rates YoY, there has been an average decline of 40% till date.

More specifically, rates on the Australia-China grain route have been trending downwards since 2H24, reflecting a decline in grain trade between the two countries.

Although rates usually dip in the first quarter due to seasonality, the January 2025 rates were nearly 50% lower YoY. If imports continue to decline and domestic production continues to rise Panamax rates are unlikely to recover to March 2024 levels in the near future on this route, Drewry concludes.