As the global community becomes more interested in- and aware of- the devastating impacts of climate change, more and more industries have shown a shift towards environmentally-friendly solutions. This could not leave the financial sector unaffected. But how financial institutions form part of the green transition?

The Paris Agreement that took effect in November 2016 was the very first ground-shaking indication that a global transition to a low-carbon economy is not only inevitable, it is urgent.

In the maritime industry, the fast-approaching 2020 sulphur cap, as well as the recent example of the initial IMO GHG strategy, which foresees an unprecedented drop of ship-related related GHG emissions by at least 50% up to 2050 compared to 2008, have also reiterated the need of decarbonization within the industry.

These recent developments were a few only indicators that it is time for businesses to embrace environmental solutions in their operations, which significantly impacts global finance.

Climate risks in the financial sector

The G20’s Financial Stability Board has identified three climate risk categories for the financial sector:

- Physical risks which include the impact on insurance liabilities resulting from weather-related incidents, such as floods and storms that damage properties and disrupt trade.

- Liability risks which include compensations for victims of climate-related incidents by those they consider responsible.

- Transition risks which include the financial risks as a result from the transition to a lower-carbon economy, with reassessment of the value of several assets.

As financial institutions cannot afford to be outside of the transition path to low-carbon economies, they seem to drain more funds into green projects than ever before.

Green finance refers broadly to the financing of investments that benefit the environmentally sustainable development: Reducing water, land and air pollution, encountering the global challenge of climate change and promoting energy efficiency from natural resources, among others.

How financial institutions support the clean energy transition

- One of the key leaders in green finance is Europe’s banking giant HSBC which has pledged to provide USD100 billion in sustainable financing by 2025, while it announced earlier this year that it would stop financing new coal power plants, arctic drilling and pipeline constructions.

- In 2008, ICBC, the world’s largest bank by assets, was the first Chinese Bank to adopt the Equator Principles, an international set of social and environmental standards for financial institutions launched in 2003. It has also adopted the Green Credit Policy launched in 2007 by the Chinese Ministry of Environmental Protection.

- Meanwhile, French banking network Societe Generale announced it integrates emissions reduction into its decision-making, when it is about new clients or new transaction, while it intends to update its long-term environmental policy in the maritime sector and particularly on the subject of fuels.

- The European Investment Bank and French BNP Baribas have agreed to finance EUR150 million worth of vessel modernization to help companies to green their fleets.

- EIB also signed with Dutch financial institution ING to support green investments for the European shipping market for a total value of EUR 300m. This agreement will ensure that sponsors of green and sustainable projects in the maritime transport sector can benefit from advantageous financial terms.

- A little earlier, in mid-2017, the US-based bank giant JPMorgan Chase announced a $200 Billion clean energy financing commitment through 2025, the largest such commitment by a global financial institution. The bank also intends to source renewable power for 100% of its global energy needs by 2020.

Business must play a leadership role in creating solutions that protect the environment and grow the economy. This global investment leverages the firm’s resources and our people’s expertise to make our operations more energy efficient and provide clients with the resources they need to develop more sustainable products and services,

…says Jamie Dimon, Chairman and CEO of JPMorgan Chase.

Green Bonds

In general, green bonds are an important part of the solution against climate change. A green bond raises finance, such any other regular bond but is specifically intended to support environmental -related projects, such as renewable energy, clean transportation, climate change adaptation, pollution prevention, etc.

The European Investment Bank was the first issuer of a climate bond in 2007, followed by the World Bank’s first labelled green bond in 2008. Since then, many public and private entities, comprising companies, cities, banks and financial institutions, are issuing green bonds, which not only helps the planet but also significantly contributes to the involved entities’ reputation.

Did you know?

Did you know?

- With over EUR 10bn raised in Green Bonds, the European Investment Bank is the world’s largest issuer.

- In 2016, IFC invested INR 2 billion (about $75.8 million) via subscription to listed, secured INR denominated bonds complying with ICMA Green Bond Principles, issued by Punjab National Bank Housing Finance in India. This was the first green bond issued by an emerging country bank for green buildings.

- Between 2005 and 2016, almost 3,500 climate-related bonds were issued worldwide by some 800 issuers, according to a report by Climate Bonds Initiative and HSBC.

- In 2017, Over 1500 green bonds were issued and their total value in issue stood at USD155.5bn, representing a 78% growth from 2016, according to CBI.

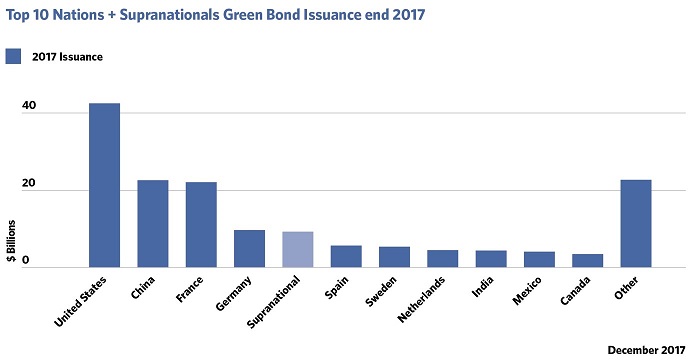

- In 2017, US, China and France, Germany, Spain, Sweden, Netherlands, India, Mexico and Canada were the top issuers of Green bonds.

- Sales of green bonds increased by 9.4 % year on year in Q1 of 2018 to $29.6bn, according to law firm Linklaters.

- China is the world’s largest carbon-emitter needing about 2 trillion yuan a year to reduce pollution, according to the country’s central bank. Unsurprisingly, China was the world’s second largest issuer of green bonds in 2017, with 118 green bonds issued of USD37,1bn worth. It is also the fastest-growing green bond market.

- The Climate Bond Initiative forecasts a USD250-300bn worth in green bond issuance for 2018. This means at least 60%+ growth from 2017.

Climate change presents risks and opportunities in both emerging and advanced economies, which paves the way for behavioral changes for the financial institutions that cannot afford to be outside of the transition path to low-carbon economies.

With the green bond market remaining at a 2-3% of global bond issuance, it is understood that more is needed, but these recent steps by major financing players are a positive a step forward.

As the impact from—and awareness of—climate change increases, it is important for financial institutions to have a clear strategy for mitigating climate risks and developing climate business portfolios. The road ahead is not always straightforward, but it is already open, with room for additional innovation

…IFC of World Bank Group advised.