The Dry Bulk Shipping Market Overview & Outlook July 2024 from BIMCO has been released which features an analysis of the dry bulk shipping market regarding supply and demand.

Supply/demand

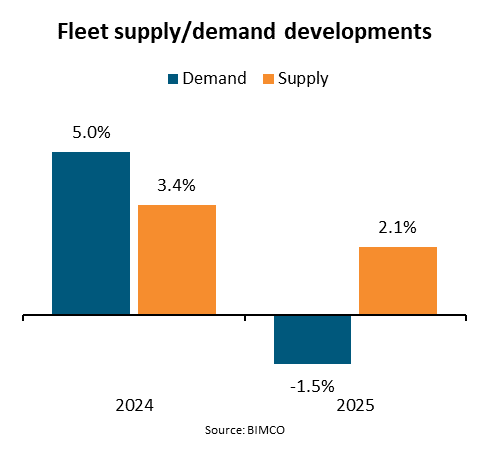

Supply is forecast to grow 3.4% in 2024 and 2.1% in 2025. In 2025, a weaker market may incentivise higher recycling and slower sailing speeds. Demand is forecast to grow 5.0% in 2024 and fall 1.5% in 2025. In 2024, rerouting via Cape of Good Hope is boosting sailing distances. The supply/demand balance should strengthen in 2024, but weaken in 2025, as ships return to the Red Sea and the Panama Canal, shortening sailing distances.

Dry Bulk Shipping Market Overview & Outlook July 2024 is now available. Read, watch or download the full here https://t.co/5hWAvGp0WO pic.twitter.com/wFLP6d3SJ7

— BIMCO (@BIMCONews) August 1, 2024

Demand

According to the IMF, Global GDP is forecast to grow by 3.2% in 2024 and 3.3% in 2025. Global economic outlook improved due to stronger economic activity in Asia. Iron ore shipments are estimated to grow 3% from 2023 to 2025. Stronger Chinese steel exports are supporting iron ore import demand. Coal shipments are forecast to fall by 1.5% between 2023 and 2025. China’s import demand is cooling, but India’s could stay strong amid a weak monsoon. Between 2023 and 2025, grain shipments are forecast to increase by 2%. Outlook weakened due to stronger maize harvests in key importers.

Supply

The fleet is expected to grow 5.5% between end 2023 and end 2025. Low deliveries and higher recycling will contribute to slower fleet growth. Ship recycling is expected to stay low. However, it may gradually increase from the start of 2025, as the market’s strength wanes. Sailing speed could fall by up to 1.0% in 2025 amid lower freight rates. In 2024, a strong market has kept speed from falling. A reduction in congestion could lead to a 0.5% increase in supply in 2024. Lower congestion primarily affected the capesize and panamax segments.