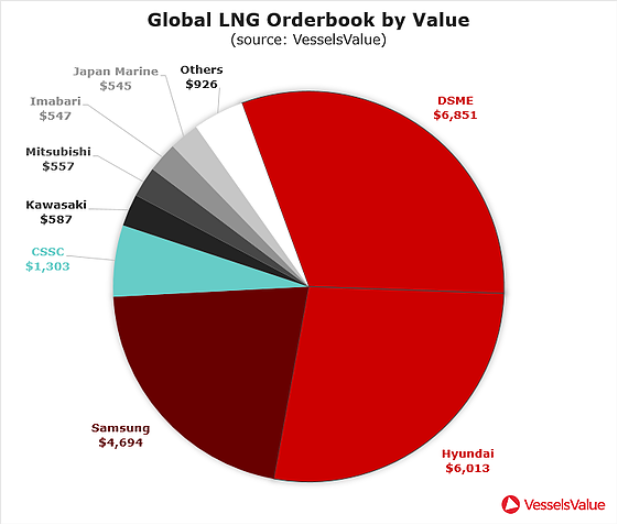

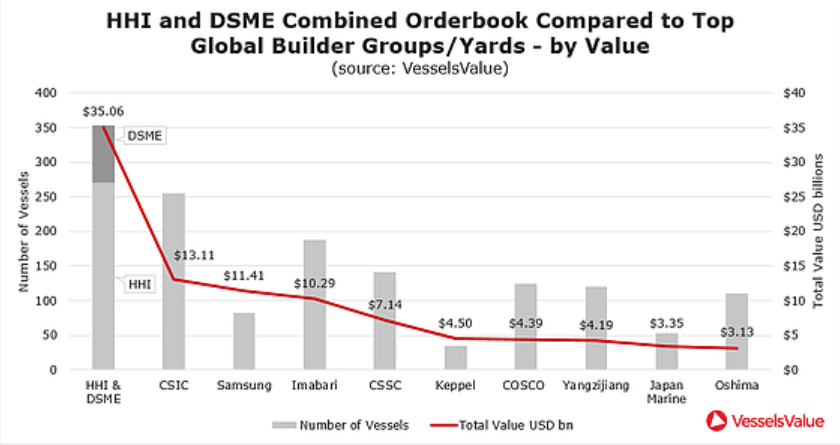

The merger between Hyundai Heavy Industries and Daewoo Shipbuilding and Marine Engineering is expected to boost the orderbook of LNG vessels, according to Vessels Value. The merger will double the orderbook of HHI from USD 6 billion to more than USD 12 million. In the possibility that the merger is official and finalized, the results will have reverberations in the newbuild market.

Specifically, the LNG area has lured a vast number of interest, following an increase in 2018 and continued investment in the midstream and downstream investment.

Natural gas will become a major part of the global energy mix for the following decades. Also, maintaining a market leading position in the construction of these vessels will be of a bog importance to the largest yards throughout the globe.

Moreover, the HHI company has a leading place in the shipyard sector when it comes to value on order. Yet, the addition of the DSME orders would further cement their position as the world’s leading builder.

Despite the dominance of HHI, a combined Samsung is still a big competitor in the LNG newbuild segment, as it lures orders from three of the largest buyers of newbuild tonnage.

Moreover, Vessels Value highlights that the combination of yards will play an important role of enhancing the pricing power overall and will also decrease loss making projects that the yards undertook in the past five years or so.

There is rising competition from Chinese builders, who are becoming increasingly competitive on high spec ships that had previously been the domain of Korean and Japanese yards.